A letter sent to - "FX United Explained"

The following letter was originally sent to the author of FX United Explained, the response was underwhelming. What has become clear, the author was never interested in providing a balanced view, acutely aware of the significant risk only invested $1,500 of his own money. The time and effort taken to create and promote the website, host and promote ‘previews’ was far in excess of the monetary commitment. It doesn’t take a rocket scientist to work out that the driver was to build a pipeline and fill his piggy bank through the upline ponzi distributions to.

I hate bullshit artists. Fortunately you leave a clumsy and easily trackable digital footprint which ASIC will be most interested in.

July 2016

Hi Andy,

Yes I did join up FX united. Primarily so I could take a peak inside the platform.

Ive read through your blog, Initially believing it to be BS marketing ploy by FX using the persona of a risk adverse professional, providing some scrutiny and raising the negatives but with the positives far outweighing the negatives. In short i believed it was a scam promoting a scam.

My view has changed considerably, my thinking leans more towards that this is a fairly honest account of the process you went through in making the assessment.

You have been consistent in your view that risk mitigation must prevail above all else which means that you are minimising your potential loss. So the worst outcome is the net difference of what you get back against your investment.

Unfortunately, the vast majority of participants that are targeted do not have this ability, they are subjected to a process and environment where when it all comes together results in not just the loss of their savings of which some have taken a decade or more to accumulate, or have emptied their pension plan given a helping hand by those that get a kick back under the guise that its yield investment is a low risk and appropriate investment for their most precious asset - their family savings and investment towards their retirement.

The false ephinany of arbitrage

But what really makes these scams so incredibly lucrative to those that peddle them, is in the simplicity of the structure. Even the most placid and risk adverse will experience a change in mindset, moving from cautious/cynic to balanced risk play to reliable yield. Its a function of time each additional monthly validation increases confidence and layer by layer removes the perception of risk. Along this timeline there is a tipping point where as a result of the build up of confidence, consistent validation fueled by other external factors, results in false belief that they have developed or unlocked financial IQ, intuition and expertise (especially since those that speculated that this was 'dodge bro' actually were wrong and you the investor was right all along). Which results in making a decision that has completely shattered the future for the investor and their families.

The arbitrage is obvious 11% return per month and the bank charges 6% per year, the dead weight of equity in the family home, an income stream which is life changing. The astute savvy investor that has emerged runs the scenario's whats the maximum available equity that can be drawn down against whats the passive income stream that would be 'life changing' for their family. The quantum of the resulting investment is in the end not driven by rationale decision making but by how significantly the external environment influences behaviour.

You mention that you were first introduced by a fast talking Malaysian Ferrari lover, (which had more of a negative impact than positive). What you probably haven't experienced is the charade in all its glory. This is part due to geography, the quantum invested (and what you are likely to invest).

Most other products have additional features - the more you invest the higher the monthly return. (FX is already in crazy land hence no tiers and their structured to induce the IB's to bring more investors to the mix).

An example of a previous ponzi scheme known as Maxim Trader is $1k investment is 3% p/m $10k investment is 5% p/m and $30k is 8% p/m. A cynic can be massaged over the line for $1k its surprising how many victims this low priced hook locks in. Then the real work begins.

The secret weapon is the events, first as an incentive to up-sell. invest $30k and get all expenses paid trip offshore for weekend to attend a Gala event. A weekend of motivation, everyone is happy, having all received a few months of cheques, experiencing what its like for those that have the holy grail of financial freedom through passive income. A place you along with everyone else has at some point yearned for. The excitement builds as you soak in the full experience, while awaiting for the world class speakers that are headlining the events. By the end of the night, while still a dream, realise many have made it.

By the second night having watched a constant parade of awards and accolades, not only to the upper echelon of the founders, but also to also to many that you quietly acknowledge that if they can clearly you can.

All of this is amplified by the power of the crowd. By the time the capital form the larger rounds begins to flow in, the frequency of events increase as does the extravagance. Fortunately, your relationship with your up-line has become pretty tight and a stroke of good fortune is its more of a mainline into the winners circle. Your not only in the loop but getting some premo benefits including an extra gala dinner of awards night. With a couple of snazzy events on the horizon you are feeling pretty chuffed. In fact, those idiots that deliberately tried to hold you back. Even if they begged, not giving them a look in. Id rather someone that would appreciate my brilliant connections and could really do with the hand up.

But this isn’t the same

You might think thats all one eyed jealous rubbish. You may not even be aware of such extravagance, you may think that sounds nothing like your guys. They might just be no nonsense brokers that are killer traders.

Well thats ok. Because regardless if they are or not, it doesn't matter. The investment as presented simply does not exist.

It can't, its mathematically impossible.

But it is the most efficient investment scam and maximise the amount that can be scammed. By comparison a wolf of wall street bucket shop is chicken feed, some that only has $10k to punt on a bucket stock. Might have $200k they can draw off their equity in their house.

Ive thought quite a bit about the process you went through, looking for the signs that this is a scam, and can see why you made some of the conclusions you did.

A couple of key variables;

- Innocent till proven guilty, distorts the process. Because there is an acceptance that the investment at its core is achievable, and the answers provided appear on face value plausible. (If you assume its possible then its pretty easy to be convinced its plausible, the real test is the money hitting your account each month).

- Asking the wrong people. those that are up-line and those who are performing the illusion are going to repeat what they say each time. 1. sending my money via that channel worked no problem 2. I'm close to the action and they know what they are doing 3. The naysayers are jealous 4. They just don't understand thats why they are the way they are. 5. Prove it. We can't show you, its proprietary methodology and technology. The proof is the payments.

Over the next week Ill point out a few things that haven't been seen or thought of but will be so obvious. Why am I doing this? Because i believe that provided the right information you will come to the same conclusions i have.

Then you will start to understand the enormity of the problem, that you unfortunately have been a champion and promoter of.

Its not about how much money you lose from this process, it the devastation that is caused to the last ones in are always the ones that lose the most, that needed it the most and will be most effected by it.

To kick things off, a couple of observations from your blog and a couple of questions to ponder.

(1) Its not about proving beyond a reasonable doubt that it is a scam.

That becomes apparent when you ask a different question.

Prove to yourself that this is is possible;

- What are the total 'minimum' returns required to make it real.

- 132% p/a to you + the kick upline + operating overheads

- the time and costs associated with putting the cash to work, unwinding it to provide liquidity for the monthly redemptions, a liquidity buffer for variances in the market. Substantially more cash on hand to ensure that in the event that an investor wants all their money back there is sufficient cash on hand to do so (the ability to redeem with little notice combined with the monthly outflows would create such tight constraints on their trading strategies, it becomes very clear just how unobtainable the minimum targeted returns are.

Not only is it an annualised return >250% on the capital that can be mobilised. This is 10x what a real fund achieves.

Regardless of what ever bullshit autobot trading crap they think they have, the odds are stacked against them to start.

A fund, have a large pool of capital to invest over a defined time period (say 5 years). they are performance driven over an agreed hurdle rate (minium required return to investors before the managers get their snouts in the trough.

8% (per annum) and then they might get 20% of the upside.

By comparison, at least 200% is required just to meet obligations, more if you incorporate performance incentives. Its far from a level playing field. Within 30 days having probably less than80% utilisation on the remaining cash after keeping aside the upline fee's means straight out of the gates they are in a challenging position.

The segregation of capital, the interruptions caused by the monthly redemptions and the ongoing liquidity requirements. Non of these questions i believe could be answered early.

So when you think about the above in the context of the overnight money market where capital would be earning 1-2% per annum. Whereas the money they have lent to trade is costing in real terms 0.5% and upwards PER DAY.

The argument that they have pools of capital from their own balance sheet (which will be used to justify how they have liquidity on hand).

Which is a ridiculous argument;

Unless they are in fact a charity, that rather than put their own capital to work properly would prefer to borrow funds that have a cost of 10-15x the current rate, dealing in small quantities which have to be administrated and managed ,costs and returns significantly impacted with monthly repayments (which never happens in finance, putting aside the forex, high yielding notes, the interest is generally PIK where repayment is rolled up till its redeemed but structured so that it the borrower can deduct the interest along the way. if it was payable it would be quarterly at best.

(2) Tax.

If they are trading in Malaysia, the profits being generated (regardless where they think the company is registered) would be creating a taxable event. They might not be generating a profit as all of that goes back to the investor and kicked upline. But you are generating a profit in which ever country the money is being put to work. Regardless of that tax, money flowing in and out of countries often are subject to withholding tax. NZ has it, Malaysia has it, Australia has it.

(3) Overnight money market.

Peter Tan used this as an affirmation of their legitimacy. Apart from the fact he is a 24 year old kid who is wet behind the ears. Quite by coincidence, this was a similar statement that someone had used in a different company (one that has blown un spectacularly torching $300-400Million). This statement is indicative to how shallow these things are. Scratch below the surface, and things fall apart quickly.

Think about this statement. If they have latent money sitting around to invest in the overnight money market they are losing money not making money. If the cost of capital to them is 12% per month = 144% pa (un-compounded) and they have $10m in the overnight money market of other peoples money (OPP).

Overnight Money Market

OPP - $10million @ 0.4% (12%/30) = $40,000(daily)

Money market - $10m @ 0.0014% (0.5%/365) = $137 (daily)

Shortfall on $10million

- Daily - $39,863

- Monthly - $1,195,890

- Annual - $14,550,000

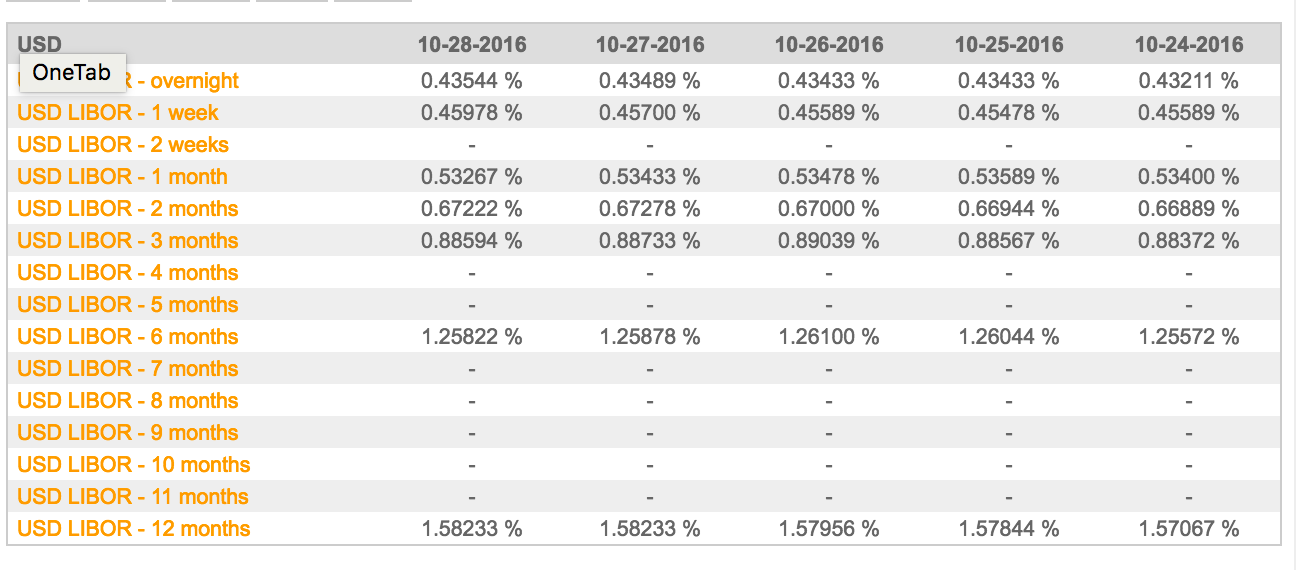

USD LIBOR Rates

Note the official London Interbank rates are annualised rates NOT daily