台灣被捲入洗錢風險?金融犯罪嫌疑者iFinex,曾是7家本土銀行客戶|天下雜誌

Is Taiwan involved in money laundering risks? IFinex, a financial suspect, was a customer of 7 local banks

[Exclusive Transnational Investigation] The financial criminal suspect who is being hunted down by the US judicial system once used Taiwan as a treasury? According to a year-long joint investigation conducted by the "World" and the International League of Investigative Journalists (ICIJ) , several cases of suspected money laundering or violations by banks and companies were found to be related to the cryptocurrency issuer iFinex, and the local banks in Taiwan were involved..

The misfortune is mostly hidden in the subtle, and most of the story starts from the subtle.

The beginning of the story is three strings of 8 numbers.

These three strings of numbers are three accounts available at Deutsche Bank, a cryptocurrency company called iFinex (services buying and selling bitcoin in US dollars).

Three series of numbers, trigger the anti-money laundering monitoring alarm bell

The founder of this company, JL van der Velde (JL van der Velde), a son-in-law from Taiwan, did two things and became famous all over the world . First, he founded the world's first large-scale cryptocurrency exchange Bitfinex ; second, iFinex's affiliate company Tether issued a virtual dollar-TEDA coin, also known as the "central bank of the cryptocurrency industry."

Starting in 2015, the three strings of iFinex numbers have triggered the alarm bell of the global anti-money laundering monitoring system.

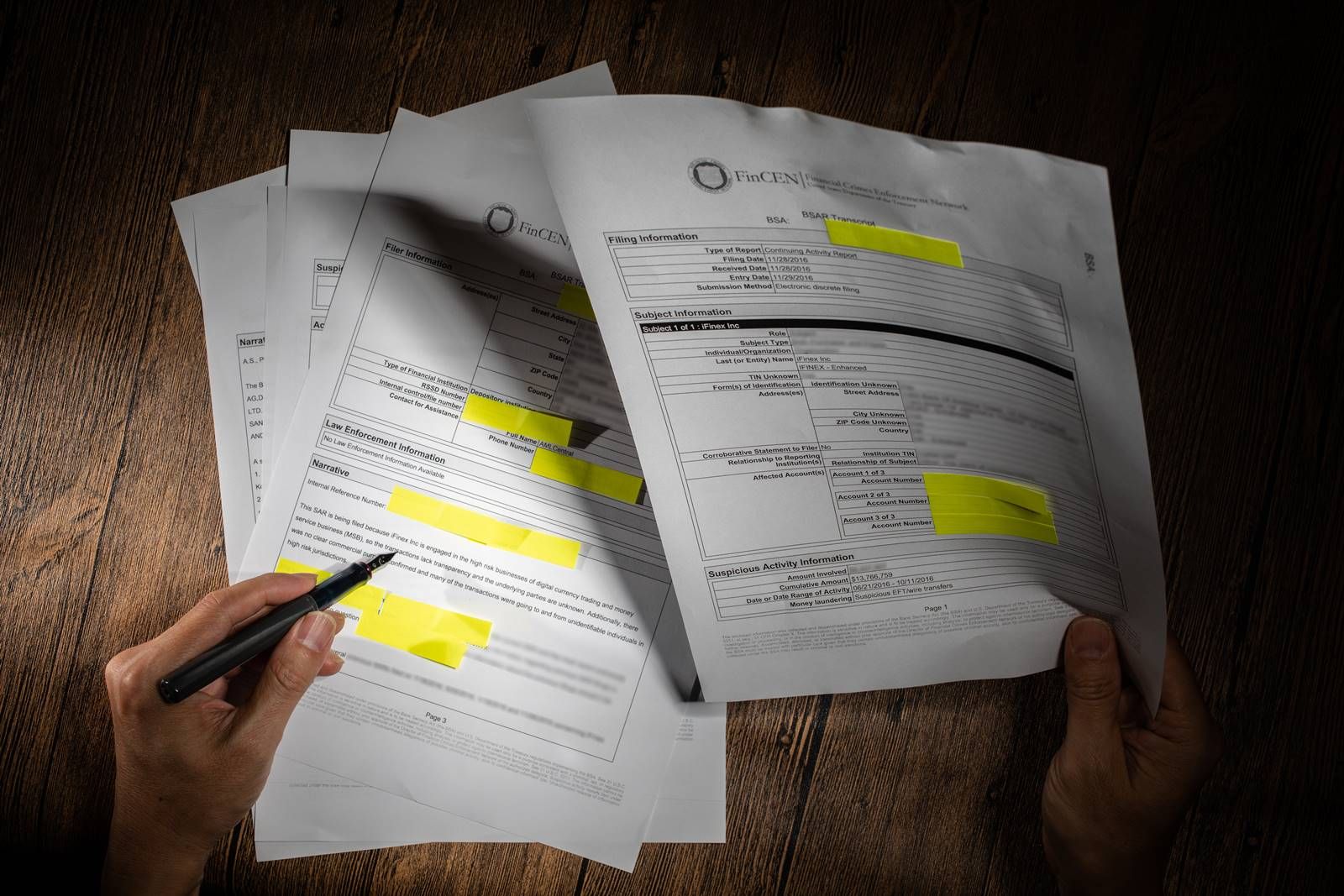

Deutsche Bank investigated the suspicious transactions of these three accounts, wrote a report, and sent it to the Financial Crime Enforcement Network (FinCen) under the U.S. Department of the Treasury on November 28, 2016. This report appeared in the investigation database of the exclusive cooperation between Tianxia and the International League of Investigative Journalists (ICIJ). The report included the names of three Taiwanese banks.

The Deutsche Bank report is collectively referred to as " Suspicious Activity Report " (SAR). SAR is a mysterious document. Banks cannot publicly acknowledge any content due to personal information and money laundering laws. SAR cannot be used as direct evidence in court because it is only used to monitor money laundering, not a conviction. However, if any bank sees that the transaction may involve money laundering, it is obliged to report it to the competent authority.

美國媒體Buzzfeed取得約2100份,主要由美元通匯銀行(負責跨國轉帳的國際大銀行),提報給FinCen的SAR,統稱為「可疑交易金融檔」,分享給ICIJ。《天下》與全球400名記者,來自近90個不同國家,埋在這堆碎紙裡整整16個月。

從2011年到2017年間,FinCen共收到了1200萬份SAR,ICIJ僅取得該期間總量的0.02%。可疑金流,就在這批資料大海裡來去自如。要用這些資料,拼湊出整個黑錢網路,就像在一萬張碎紙堆,嘗試用兩張小破片拼湊起一幅畫。

但是,從兩張小破片中,卻可以清楚地拼出,一家從台灣影響全球加密貨幣市場的公司,怎麼讓台灣本土銀行可能捲入洗錢網絡中。

從台灣匯款,生意伙伴涉詐欺

一份可疑交易報告指出,iFinex的三個德銀帳戶,在2015年11月至隔年10月,短短一年間,就觸動了5次德銀警報,總交易金額達1377萬美元(約4.1億台幣)。

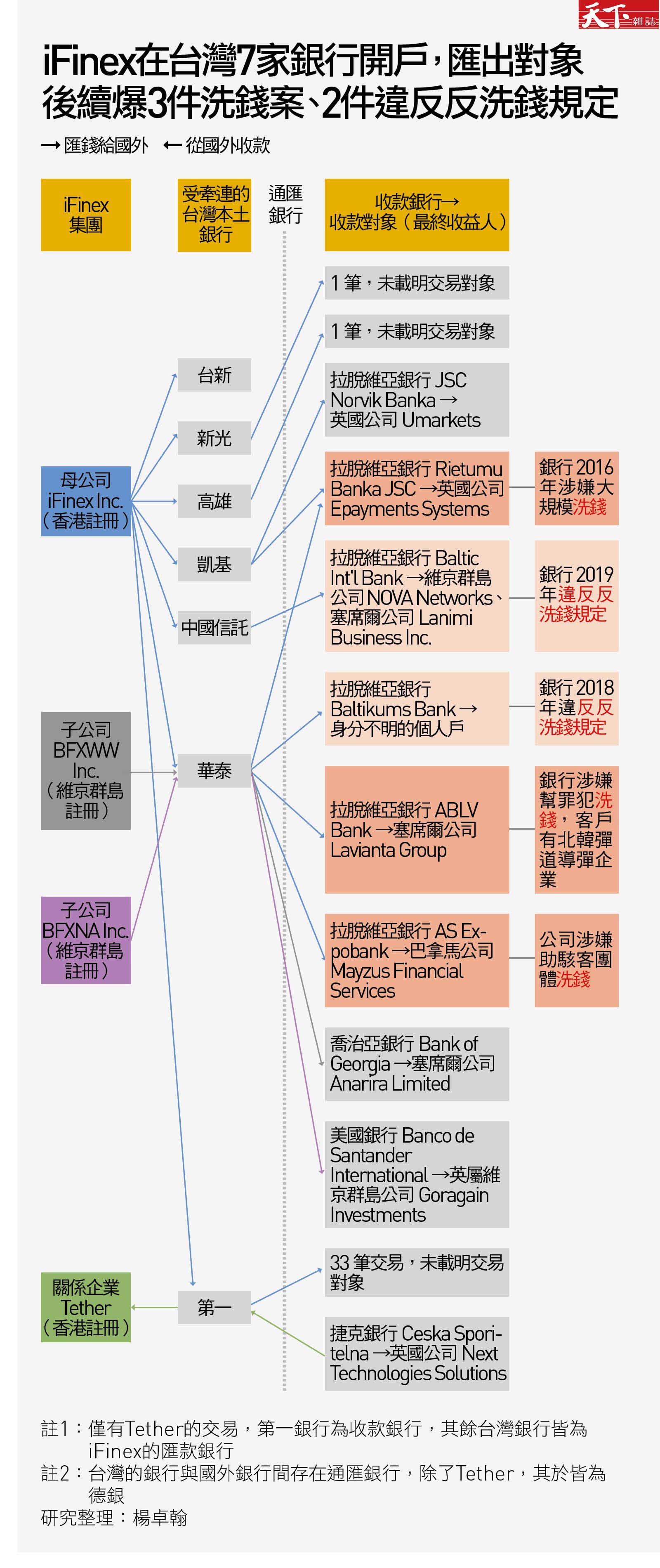

報告內144筆交易,其中有33筆使用第一銀行,1筆新光銀行,1筆高雄銀行。

德銀舉報交易,有四大可疑原因。第一,iFinex是金融服務商,又從事高風險行業的虛擬貨幣交易。第二,交易缺乏透明性、交易對象不明。第三,交易沒有清楚商業目的。第四,交易往來地區包括洗錢高風險地區。

報告指出,iFinex有一名生意伙伴Eugeni "Zhenya" Tsvetnenko。根據澳洲媒體報導,此人去年12月被紐約檢察署以電匯詐欺起訴,於澳洲珀斯的家中被逮捕。

報告也指出iFinex在2015年,與Axiom Holdings交易。根據美國媒體報導,這家公司因為涉嫌詐欺,在2017年被美國證券交易委員會發出法院傳票。

《天下》求證3家銀行。新光、高雄銀行表示,於2017年之後,都沒有再與iFinex往來。上述銀行當時受理與該集團業務,均依當時洗錢防制規定辦理。第一銀行表示,因未取得相關資訊,無法回覆

除了母公司,《天下》與ICIJ資料團隊在外洩資料中,發現iFinex還有3家公司,也用台灣的銀行做可疑交易。

台灣辦公室就在金管會附近

iFinex台灣分公司「英屬維京群島商艾非倪司有限公司」,代表人就是方雋哲,辦公室在板橋文化路一段。隱身在一棟低調的大樓裡,距離金管會走路僅15分鐘。

其子公司Tether在香港成立,也在台灣有辦公室。另有BFXWW Inc.及BFXNA Inc.兩家維京群島子公司。

這4家公司在SAR裡的登記地址,都在香港中環夏慤道12號美國銀行中心。有趣的是,香港金融管理局就在隔壁的16號。

這4家公司都曾是台灣的銀行客戶。除了上述德銀報告指出的3家,還有中國信託、華泰、凱基銀行。在一份公開的法庭文件中還出現台新銀行。

這7家台灣本土銀行,就是iFinex在台灣所使用的銀行。

交易對象有洗錢、高風險銀行

透過台灣,它與遠在維京群島、巴拿馬、拉脫維亞的對象交易,包括金融犯罪嫌犯。

華泰銀行表示,iFinex已非客戶,當時受理業務均遵循法令。凱基銀行表示,無法回應特定客戶資訊,執行作業均依法。中信銀表示,相關資訊只能依法揭露予有權機構。台新則不予回應。

2015年4、5月間,iFinex透過華泰銀行,匯錢給其他在拉脫維亞波羅的海銀行(Baltikums Bank)、ABLV銀行開戶的對象。

同年9月及10月,iFinex用中國信託銀行OBU帳戶,匯錢給在拉脫維亞波羅的海國際銀行(Baltic International Bank)開戶的塞席爾公司。

這3家拉脫維亞銀行都因違反洗錢規範遭罰。ABLV更被美國財政部指控,該銀行大部份客戶是高風險的空殼公司,有數十億美元非法資金洗錢,客戶包括俄羅斯、亞塞拜然和烏克蘭等罪犯,以及與北韓彈道導彈計劃有關的企業。

ABLV正在被歐洲央行接管清算中,銀行不能對任何客戶有任何評論。

iFinex remits money through Huatai Bank, as well as Mayzus Financial Services, a company that opens an account in a Latvian bank. At the end of 2019, this company was accused by the anti-corruption organization Global Witness for serving the notorious cryptocurrency money laundering platform BTC-e and helping the Russian government-supported hacker group to launder money.

In suspicious transactions, iFinex uses the cash flow network established in Taiwan to communicate with two parties: either with potential money laundering targets, or overseas companies hidden in money laundering paradise.

iFinex is a variant of "decentralization". Its perfect shape is: the treasury is located in Taiwan and the company address is in Hong Kong, but it is actually an offshore company in the Virgin Islands. Use this complex and fragile structure to issue virtual currencies to global investors and challenge US financial sovereignty.

The TEDA coin it issues is the most commonly exchanged stablecoin in the Bitcoin circle, so it is called the central bank of the cryptocurrency industry, but it is often accused of being the culprit in manipulating the price of Bitcoin. The bitcoin address (ie account) of the iFinex exchange was accused by the U.S. Department of Treasury of being used for drug trafficking last year.

"He has a feeling for Taiwan."

The Dutch founder Fang Junzhe, why set up the treasury in Taiwan? "Fang Junzhe has a passion for Taiwan," observes Hu Yitian, founder and CEO of Yuanbo Capital, who is familiar with the blockchain industry.

"He feels that Taiwan can use the power of technology to take finance to the next level. Cryptocurrency is that power."

Fang Junzhe used to come to Taiwan as an international student and graduated from National Taiwan University in 1988. Prior to founding iFinex, he had been engaged in trading in Taiwan for nearly 30 years. He served as the sales president of Tuxia in Taiwan, selling system software.

After founding iFinex, Fang Junzhe recruited troops in Taiwan. It is understood that there were more than 50 employees in Taiwan during its heyday. The main departments include engineers, finance, legal compliance and customer service.

Zheng Guangtai, the founder of Taiwan's largest cryptocurrency exchange "Bito", is Fang Junzhe's former employee in Desia.

"He is a visionary boss," Zheng Guangtai said. However, Zheng Guangtai had already started his own business at the time, so he did not join Fang's cryptocurrency company.

Professor Liao Shiwei of the Department of Science and Technology of National Taiwan University met Fang Junzhe in 2015. "At that time, he spent a lot of time in Taiwan and visited many government officials," Liao Shiwei said. Some students also worked under Fang Junzhe's.

Fang Junzhe also started classes with Liao Shiwei at the National Taiwan University of Science and Technology. It was only halfway through the semester, and only Liao Shiwei was in class because the treasury established by Fang Junzhe in Taiwan was being dismantled by American banks.

3 years ago, Taiwan's gold stream was cut off

In mid-March 2017, US banking giant Wells Fargo informed four Taiwanese banks including First, Taishin, KGI, and Huatai that it would immediately cut off US dollar transactions with iFinex.

A month later, the lawsuit filed by iFinex stated that the actions of Wells Fargo Bank suspended all iFinex USD transactions. Because it relies on Taiwanese banks to do business with global customers.

As long as the four local banks in Taiwan are attacked, the gold flow of this global cryptocurrency central bank will be completely blocked.

"He has trouble even doing business in Taiwan," said an anonymous industry source. "Wells Fargo immediately ordered the cut-off of transactions. Which Taiwan bank is not afraid to see it?"

"Wells Fargo is one of the major international U.S. dollar exchange banks. You can't offend it," said a U.S. bank executive. "As long as there are foreign customers, such as Microsoft customers who want to send money to domestic banks, they must go through the exchange bank. It’s a terrible thing to cut off the account."

In addition, one year before the incident, the New York branch of Mega Bank had just been severely fined by the New York authorities, and anti-money laundering became a prominent lesson. In 2017, some banks in Taiwan took the initiative to clear their iFinex accounts and no longer contact them.

Moved to Europe, still very close to crime

After the Wells Fargo incident, iFinex moved to Switzerland and also recruited former anti-money laundering consultants from Royal Bank of Canada and Bank of Montreal to serve as legal compliance chief in 2018. But the distance from financial crime is still very close.

It later cooperated with the Panamanian bank Crypto Capital. It was unexpected that the bank’s chief executive was arrested by Polish police last year on suspicion of using iFinex’s exchange to launder money for Colombian drug cartels. iFinex once again suffered heavy losses due to bank funds being unable to move. iFinex Exchange stated that it is a victim of fraud.

"It grew out of a gray area on the edge of the financial system. It will take a long time for it to be fully legal and compliant," said Hu Yitian. Fang Junzhe represents a revolution that overthrows the traditional financial system.

"Tianxia" sought to verify iFinex and its exchange Bitfinex related company cases and Fang Junzhe reported the facts, but still did not respond to the deadline.

Cryptocurrency anti-money laundering, Taiwan has yet to set the tone

但是,不是每個加密貨幣業者,都被美國追殺。例如美國納斯達克,就和7家通過審查的加密貨幣業者合作,追蹤洗錢等不法活動。

盡快將加密貨幣納入金融體系管理,而非一味封鎖其金流,才能有效降低洗錢風險。

國際組織「防制洗錢金融行動小組」,去年發布加密貨幣監管的指導方針,要求業者執行傳統金融反洗錢的國際轉帳規則,記錄每一筆加密貨幣的轉帳資料。

「加密貨幣的交易,其實都追蹤得到,」庫幣科技執行長歐仕邁說,他推出的加密貨幣反洗錢解決方案「Sygna」,就是用來防堵漏洞。國內幣託與MAX兩家交易所,都已導入。

目前,新加坡已通過「支付服務法」,對交易所納管,並要求業者須符合國際轉帳規則。不過台灣主管機關,還沒有對加密貨幣業者的反洗錢規範提出草案。

金管會表示,台灣去年獲亞太防制洗錢組織(APG)評為最高評等。台灣公、私部門都全力投入,落實國際洗錢防制規範。

加密貨幣洗錢防制規範相關草案已在擬定,也不斷與台灣本土加密貨幣業者溝通,滿足國際相關標準。

Three strings of numbers and an encrypted currency exchange have put Taiwan's financial industry in danger of money laundering. If the competent authority does not speed up the response, the new high price of Taiwan’s fines in Taiwan’s history, which was heavily fined by the United States of NT$5.7 billion, may be broken. (Editor in charge: Wang Lihua)