Searching for Cynk: The $6 Billion Penny-Stock Debacle, From Belize to Las Vegas

Published by Jakal Intel

Searching for Cynk: The $6 Billion Penny-Stock Debacle, From Belize to Las Vegas

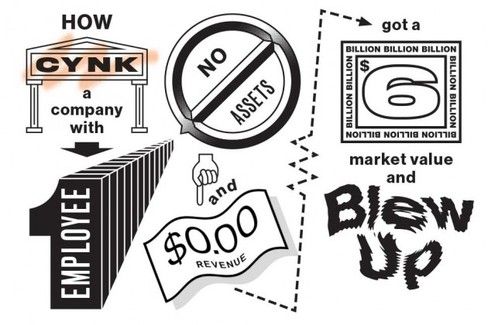

How a company with one employee, no assets, and $0.00 revenue, got a $6 billion market value and blew up

The Matalon, a six-story glass building in Belize City, Belize, towers over a lot littered with old refrigerators and washing machines. Jagged rebar sticks out of unfinished cinderblock structures nearby, and the view, across Haulover Creek, is of a cluster of corrugated metal shacks. This is the listed address for Cynk Technology, a company with no assets, no revenue, and one employee, that for one hour in July had a market value of more than $6 billion.

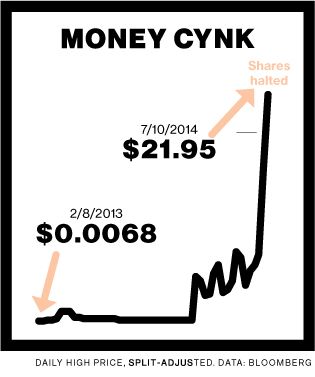

Until that inconceivable run, no one had ever heard of Cynk or the social network it claimed to operate—no one, that is, outside the murky, volatile market for penny stocks, where fraud is rampant and regulation scant. Cynk had begun trading in 2013, for a few cents a share. The price stayed there, hugging the bottom, until June 17, 2014, when shares that had last changed hands at 6¢ spiked to $2.25, a gain of 3,650 percent. The stock kept surging, drawing the attention first of penny stock gossips, then the sharper finance blogs, and finally—as Cynk’s gain topped 36,000 percent, giving it a greater worth on paper than companies such as Urban Outfitters—all of Wall Street. On CNBC, in the New York Times, and all over Twitter, the strangest story of the summer was the mystery listing from Belize.

Calls to Cynk go unreturned. In filings with the Securities and Exchange Commission, Cynk lists its offices as the Matalon’s Suite 400. There is no Suite 400. The building manager says the company has never had an office there. There are no $6 billion companies in all of Belize, a country where workers earn as little as $80 a week. What Belize does have is a reputation as a haven for offshore businesses with difficult-to-trace records and little oversight.

Among the operations that have set up shop are penny stock promoters who blast out e-mails and tweets hyping shell companies. One of the biggest boosters tied to Belize, AwesomePennyStocks, was able to stay anonymous until the Bugatti- and Lamborghini-driving 26-year-old behind it was sued in March by U.S. regulators. He settled on July 7 for $3.6 million without admitting the allegations. Another promoter, Victory Mark, lists an address in the nearby town of Ladyville. A visit there confirms the road exists, but it has no street numbers and is patrolled by stray dogs. Victory Mark didn’t respond to a phone call and an e-mail.

The person identified in filings as Cynk’s chief executive officer until mid-June, Javier Romero, grew up in the island town of San Pedro, where everyone knows everyone. Romero worked as a park ranger at a local marine reserve, says Daniel Guerrero, San Pedro’s mayor. On YouTube, under the name "Young Soldier," Romero can be seen singing the hook on a reggae music video titled San Pedro (I Love You). His weathered family home, constructed of plywood sheets, stands out as particularly decrepit in a poor settlement a little out of town. An overturned golf cart lies in front amid ferns strewn with buckets and trash. There’s an outhouse off to one side.

Romero’s grandfather, Joe, is sitting outside on a recent afternoon. He says Javier, whose age he gives as 26 or 29, has left for the U.S., where he’s studying to be a pilot. Asked about Cynk, he explodes. "He doesn’t own anything!" he says. "That is crap. All the crap on the Internet—those are crap! He has nothing to do with it."

Cynk Technology was born on May 1, 2008, when a Seattle man named John Kueber incorporated a company in Nevada under the name Introbuzz, according to state records. Nearly four years passed, with no apparent activity, until January 2012, when Introbuzz filed with the SEC to sell shares to the public. The startup wanted to raise as much as $100,000 to launch a new type of social network competing with the likes of Facebook and LinkedIn. The difference was that Introbuzz users would pay for introductions—to celebrities, business contacts, or even "the right squash player." The company would make the networking lunch passé: "Instead of paying for a lunch that neither party wants to eat, parties can get down to business knowing that their time has been valued."

Kueber (pronounced Keeber) sold Introbuzz in late 2011 to a Las Vegas man named Kenneth Carter for $600, the documents say. The risks section of the SEC filing noted, in capital letters, that Carter had zero public-company experience. Carter, who went by the name Kenny Blaque, ran a promotions company called Blaque Technology, which lists life-size stickers called Wall Dawgz and Wall Dolls among its products.

The SEC showed some concern, asking Introbuzz a series of questions in four comment letters, before approving the offering. The shares began trading on Feb. 7, 2013, on the over-the-counter market, the modern, electronic version of the sidewalk trading that used to happen outside the stock exchange. Carter resigned a month later, replaced by Marlon Luis Sanchez, who worked as a spokesman for the medical tourism industry in Tijuana, Mexico. Sanchez approved a 75-for-1 stock split and a name change. On July 23, 2013, Introbuzz officially became Cynk Technology Corp.

Both shorts and longs got trapped

Three weeks later, the company issued a notice that it had moved offshore, to a building in Belize called the Matalon. Cynk soon ceased making its required quarterly and annual reports. The CEO merry-go-round continued, with Sanchez replaced in February by Javier Romero, who was himself replaced on June 18 by Howard Berkowitz of Costa Mesa, Calif. That was the day after Cynk shares made their curious 3,650 percent leap.

Attempts to reach Sanchez, Romero, and Berkowitz were unsuccessful. Carter, reached by phone, says he wasn’t involved in the stock spike: "I’m not a stock man. I just create Internet work. I don’t know why they would manipulate everything. It’s mind-boggling to me." Kueber, also reached by phone, says he doesn’t know who is running Cynk. "No idea what’s going on," he says. "I’ll let you guys figure it out from there."

Even the august New York Stock Exchange has been described as a casino—a place where individuals risk big losses by betting on single stocks. If that’s true, then the market for penny stocks is like a more perilous game held in a gambling house’s backroom, with fewer protections, greater threat of going bust, and more outright scams. It can take the SEC years to shut down any given scheme, and an unknown number go unchecked.

Why do these markets keep going? Some legitimate small companies do use them to grow. But many investors are lured by the jackpot appeal of a stock they bought for a cent or two doubling or quadrupling in value overnight. And some think they can spot scams in the making and dart in and out at a profit.

That’s what excited Matthew Fromm. With a day job at a Chicago telecom brokerage, Fromm, 27, trades stocks in his spare time. He’d discovered Cynk in the spring of 2013 as he poked around ETrade on his laptop after his infant son went to sleep; he noticed Cynk’s low price and suspiciously high volumes. The company seemed bogus, but Fromm didn’t care. He saw what he considered the telltale signs of a "pump and dump."

Pump-and-dump schemes are as old as the stock market itself. The playbook: A promoter buys a long-dormant company with tradable shares, or creates a new one and issues stock. The promoter controls most of the shares outstanding but keeps his name out of official filings, appointing a token officer. Then he starts trading shares back and forth with confederates at gradually increasing prices, using spam promotions now sent by e-mail or social networks to lure in marks—real investors on whom the schemers can dump shares at a huge profit. Penny stock scams have a long history of seizing on the hot industry of the moment—gold mines in the 1930s, or, today, legalized marijuana and digital currencies.

Fromm aimed to ride the pump. "The trick with trading penny stocks is being ahead of the curve," he says. "You’ve got to get there before the pumpers do." He bought 2,500 shares for $250, or 10¢ each, in 2013 and tucked them away in a file labeled "Lotto Picks."

There’s another way to profit on pump-and-dump schemes: spot an obviously inflated stock and short it. That’s what Tom Laresca, a market maker at New Jersey brokerage Buckman Buckman & Reid, did on July 8 after a widely read blog called ZeroHedge brought Cynk to national attention. Laresca, who has 30 years of experience on Wall Street, says he bet against the shares at about $6 each. Shorting involves borrowing shares and selling them, in hopes of buying later at a cheaper price so the borrowed shares can be returned at a profit. It’s not for the faint of heart: Stock lenders can recall those shares at any time. If the price has gone up, the short sellers can be forced to "cover" at theoretically unlimited losses.

Laresca—who had put on an even riskier form of the trade known as a naked short—figured the stock would fall on its own as more people discovered its absurd balance sheet and nonexistent product or if the SEC suspended trading. Instead, the shares doubled on July 9, starting a "short squeeze"—a mad rush among traders to buy stock and reverse their short positions. Laresca, who declined to give the size of his losses, lost his job. "I just don’t understand how this was allowed to happen," he says, sounding forlorn.

Another theory emerged on July 10, as Cynk hit $21.95 in intraday trading and its valuation eclipsed $6 billion. Paulo Santos, an independent trader from Portugal, wrote about the stock in a blog post, on the website Seeking Alpha, that quickly went viral on Wall Street. Santos described a modified pump and dump: Cronies controlling virtually all of the shares had set a trap for short sellers by lending them stock, he posited. After bidding the price up further among themselves, the theory went, they recalled the shares, forcing the shorts to pay a price of their choosing.

Regulators finally stepped in on July 11, when the SEC suspended trading for two weeks, citing concerns about the accuracy of disclosures and potentially manipulative transactions. Both shorts and longs got trapped by the halt. Short sellers must still pay for borrowed shares during the stoppage. Longs are stuck with paper gains until trading resumes—at which point their shares may head to zero.

Fromm, at least, won big. When the stock hit $20 on July 10, an automated sell order kicked in, giving him a 200-fold gain of almost $50,000. "I should have never got a chance to sell at $20," he says. "If the SEC really cared about the people playing the pennies, they would have halted it. If the government really cared, they could clean it up. I think they just think it’s gamblers."

In the Wild West of penny stocks, along with the gamblers and the scammers, there’s something like a vigilante brigade, private individuals who take it upon themselves to find the promoters behind the shadiest listings. As Fromm, Laresca, and others were making their bets, these amateur investigators—posting on online forums such as Investors Hub—noticed John Kueber, the guy in Seattle who had founded Cynk’s predecessor in 2008. His brother, Phil, had been affiliated with several small companies whose shares had popped before collapsing, state and SEC filings show. Financial authorities in Canada had cited him in 2005 as running an unauthorized banking scheme. A "Phil Keeber" was listed on a form releasing the name Cynk Technology to Introbuzz in Nevada in 2013. In a phone interview, Phil Kueber says he’s consulted for Cynk but wasn’t involved in manipulating its stock or any other. "I never bought a share, I never sold a share," he says.

Phil Kueber’s résumé is a bizarre mix of entertainment ventures and energy-related investments. He has a screenwriting credit for Screwball Hotel, a 1988 pranks-and-boobs comedy in which teen heroes save the hotel by uncovering a corrupt minister’s financial shenanigans. He later teamed up with the director, turning a film studio into a penny stock company in 1997.

Phil Kueber arrived in San Pedro shortly after Cynk’s relocation to Belize in August 2013. Kueber wouldn’t stand out among the aging, sunburnt gringos cruising the town’s three bar-lined streets in golf carts after dive and fishing trips. He bought a condo there in September, according to Lisa McCorkle Guerrero, the real estate developer who sold it to him.

Back on the mainland, while there’s no sign of Cynk Technology on the fourth floor of the Matalon building, the company does have a link to that floor: Titan International Securities, whose blue centurion logo is visible behind a glass door. The offshore brokerage held millions of shares of Cynk stock for clients this year, according to documents obtained by Bloomberg. In a statement, Titan said it returned the shares because they didn’t meet internal compliance rules.

Titan came up recently in a U.S. sting operation. When the FBI tricked some penny stock promoters into hawking a bogus listing, they called Titan when they needed to sell the shares, an SEC lawsuit against the promoters claims. Titan says it’s cooperating with authorities on the case.

Gian Ghandi, 81, has been in charge of Belize’s offshore financial businesses since regulation began 15 years ago. The industry now generates about $13 million a year in fees for the government, he says. He works off a dark corridor in a government building in Belmopan, the country’s capital, where security guards wave visitors through a broken metal detector. He says he hasn’t heard about the FBI sting. "Is that so?" Ghandi says. "Nobody asked me these questions, quite honestly."

"The whole thing, all the trades, it was too much for us," he says. "I do not assume that they’re doing something illegal or fraudulent." Ghandi says he checked, and Cynk was never registered as a company in Belize. He says he’s never been sure why it used that address. "It’s still a little mystery to me," he says.